Friday 29th August | Join Free

Hello, this is your Friday Beyond the Basket brief. In today’s issue we break down how wealthier shoppers could be quietly eating into your margins via higher return rates. We also spotlight Alibaba’s rare feat in making global ecommerce profitable, M&S’s Gen Z menswear push, and a logistics land grab sparked by new U.S. tariffs. Plus, a 4.4M-customer breach with big vendor risk lessons. Let’s jump in 👇

In today’s beyond the basket:

🛍️ Wealthy Shoppers Drive Higher Return Rates

🌍 Alibaba’s Cross-Border Growth Turns Profitable

🧥 M&S Targets Gen Z Men with New Style Channel

🔒 TransUnion Breach Exposes 4.4M Customers

+plus four deep reads and analysis and a tool that could save you from missing out on sales.

🛍️ Wealthy Shoppers Drive Higher Return Rates LINK

TL;DR: A Bank of America Institute report found higher-income households refunded 5.3% of purchases in 2025, compared with 3.7% for lower-income shoppers.

Why It Matters: Wealthier consumers are more likely to buy speculatively, or “bracket” purchases (ordering multiple items, returning most). This fuels higher sales volumes but piles on costly returns for retailers. With nearly half of consumers making multiple returns monthly, the pressure on margins is only growing.

Your Move: Build returns into your margin, don’t treat them as an afterthought. Track return rates by customer segment and product category, then adjust pricing, inventory buys, and marketing offers accordingly. For high-income or fashion-forward shoppers who buy-to-try, design policies that absorb the cost without eroding trust, for example, offering free returns only on full-price items or incentivizing exchanges over refunds.

🌍 Alibaba’s Cross-Border Growth Turns Profitable LINK

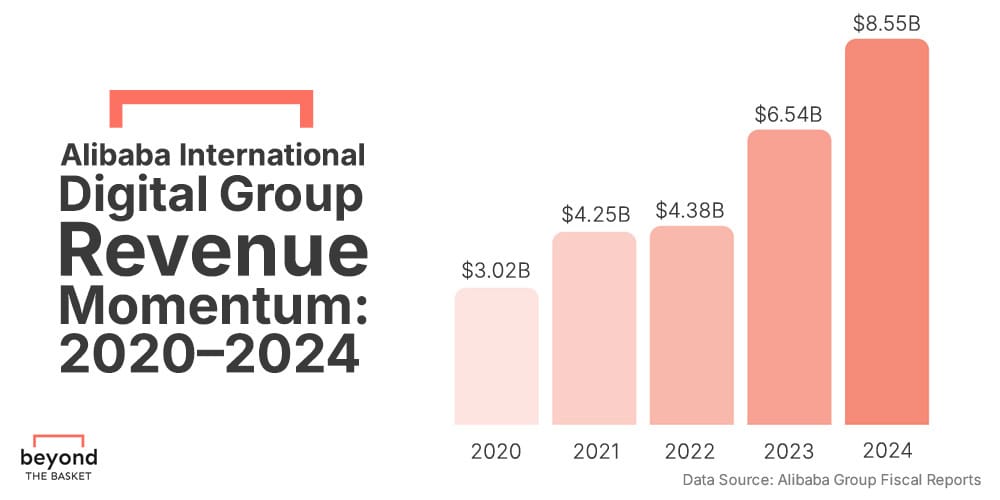

TL;DR: Alibaba’s International Digital Commerce Group (AIDC) grew revenue 19% YoY while narrowing losses through logistics efficiencies in AliExpress Choice and Trendyol.

Why It Matters: Global ecommerce expansion often burns cash, but Alibaba shows that tight logistics and operational discipline can flip cross-border from a drag to a driver. For mid-sized brands, this highlights the importance of localized fulfillment, efficient returns, and tailored payment systems before scaling abroad. Profitability comes not from chasing new markets alone, but from building the infrastructure that sustains them.

Your Move: If you’re eyeing international growth, start with logistics, secure cost-effective fulfillment and delivery partnerships before ramping spend on customer acquisition.

Alibaba International Digital Group Revenue Momentum: 2020–2024 Data Source: Alibaba Group Fiscal Reports

🧥 M&S Targets Gen Z Men with New Style Channel LINK

TL;DR: M&S launched M&S Man, a dedicated Instagram channel aimed at the 18–34 menswear market, supported by ambassadors and influencers.

Why It Matters: Social media is now the top driver of menswear purchases for younger shoppers, with this demographic twice as likely to be influenced by online style content or celebrity collaborations. By blending content, community, and commerce, M&S is positioning itself to grow beyond its current 10.4% share of the £10.75bn UK menswear market. The play underscores how fashion retail is shifting from seasonal campaigns to always-on social storytelling.

Your Move: Treat social as an always-on storefront, pair daily content with frequent product drops and make sure every post links smoothly to purchase, turning influence into sales.